⚡ Deploy Business Rules in Minutes

Turn Business Rules Into

Revenue

The AI-powered decision engine that transforms complex business logic into competitive advantage. Scale operations 10x faster.

Built for Leaders Who Win

Executives who can’t afford another delayed launch

The Automation Imperative

Speed Defines Success

AI Amplifies Intelligence

Consistency Creates Trust

🏆 Enterprise AI Innovation Award 2023 🔒 SOC 2 Type II Certified

Why Enterprises Choose decision.ezee

Transform operations with intelligent rules automation

The Cost of Manual Operations

What traditional processes cost your enterprise

- Current Challenges

IT Bottlenecks

Every business rule change requires IT development cycles.

Impact: 6-month delays for simple changes

Inconsistent Decisions

Manual processes create varying outcomes and errors.

Cost: 15-20% operational inefficiency

Scaling Limitations

Growth requires proportional workforce increases.

Challenge: Linear cost scaling

- Your decision.ezee Future

Business Autonomy

Teams manage their own rules without IT dependency.

Result: Same-day rule deployment

Intelligent Consistency

AI ensures optimal decisions every time.

Impact: 40% efficiency improvement

Unlimited Scale

Handle exponential growth without workforce increases.

Achievement: 10x processing capacity

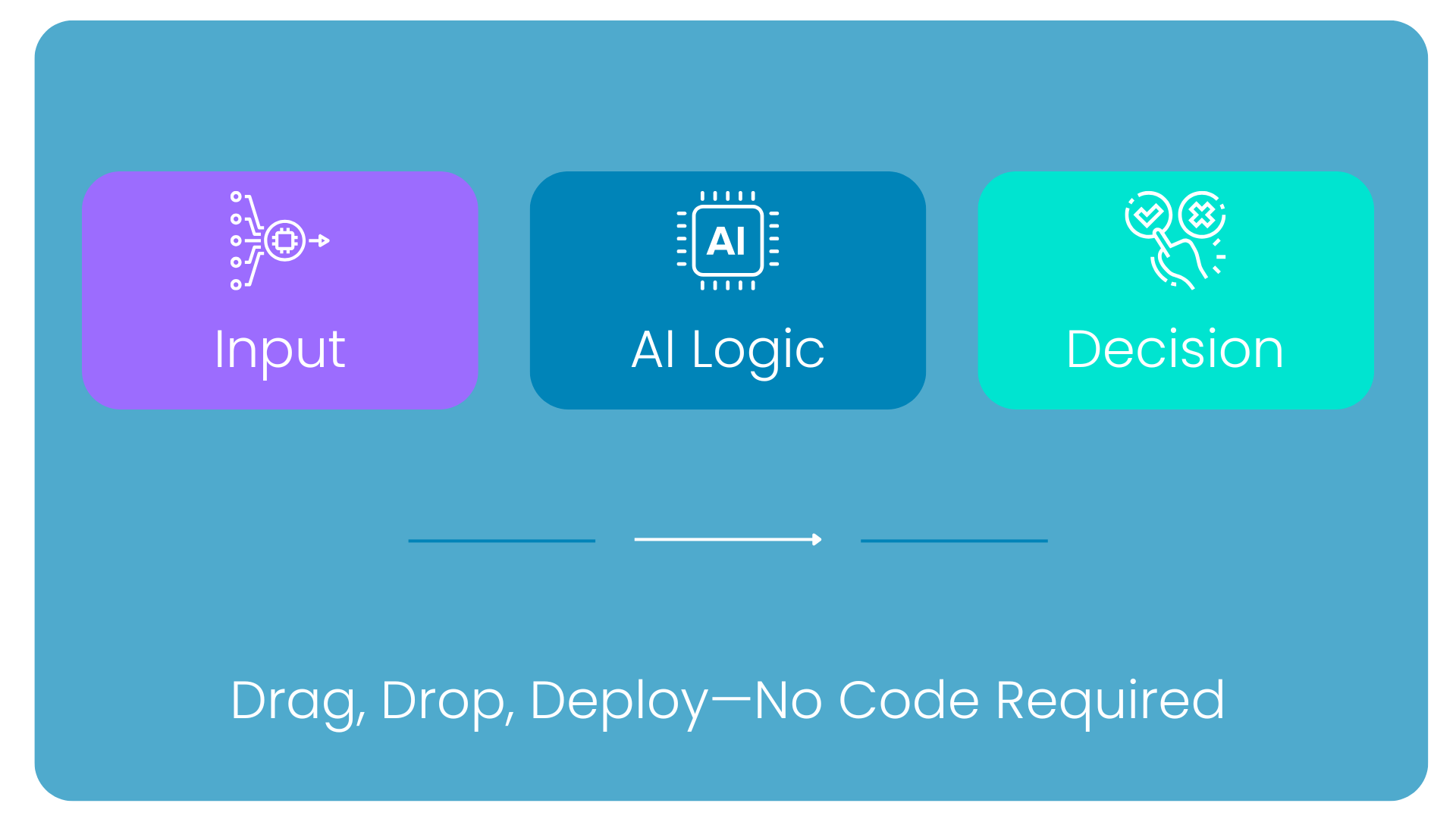

Why Decisioning Feels Effortless with decision.ezee

Every capability solves a blocker you’re tired of facing.

Excel-Compatible

Empowers credit teams to update logic in familiar tools and sync seamlessly, cutting turnaround time.

Integrate Anything

No patchy middleware. Build decisioning on real-time, multi-source data.

JSON-Friendly, Credit-Ready

Seamlessly parse and route any complex credit application or KYC format from partner APIs or loan apps.

Formulas, Constants & Knockouts

Use no‑code formulas and dynamic variables to calculate custom ratios, thresholds, and disqualification rules.

Always-On Smart Logs

Enables audit trails, faster debugging, and intelligent refinements to credit strategy.

Multi-Tenant. One Platform.

Whether it’s regional compliance rules, department-level logic, or multi-brand governance—decision.ezee ensures every team works in its own secure space.

Workflow Engine for Rule-Based Triggers

Automates next steps post-decision—like KYC, rejection workflows, or routing to legal queues.

Rules-Based Access & Control

Aligns teams across management, compliance, and operations—without risk of overreach.

Real-world use cases that drive measurable results

Executives who can’t afford another delayed launch

Built for Your Growth

Scale without limits, implement without delays

While You Deliberate, Competitors Accelerate

Automation isn’t a future investment—it’s today’s competitive necessity. Every manual process is a competitive disadvantage.

300x

Faster Deployment

95%

Less Decision Time

89%

Reduced IT Dependency

Your Complete Lending Technology Suite

Three powerful platforms that work together to transform how you

build, deploy, automate and manage lending products.

Launch Credit Products in Weeks, Not Quarters

Cut loan processing time by 70%

Boost STP rates by 50%

Turn Collections into Customer Conversations

Cut collection cycle times by 60%

Handle 10x more accounts

Optimize, Automate & Accelerate Lending Decision

Launche complex rules in minutes

Reduce decisioning time by 80% with AI

Ready to Leave Competition Behind?

See how decision.ezee revolutionizes your lending operations in a personalized demo.

Your Demo Includes:

- 5-minute rule deployment demo

- AI suggestions for your policies

- ROI calculator for transformation

- Custom implementation roadmap