Launching a new loan product is one of the most cross-functional, high-pressure efforts in modern banking. It’s not just about getting the underwriting logic right. It’s about aligning multiple departments—credit, risk, compliance, operations, legal, product, and technology—under tight deadlines and even higher expectations.

Each team brings different priorities to the table.

Risk wants predefined thresholds and fallback logic.

Compliance insists on traceability and transparency.

Sales teams are already speaking to the market.

And the leadership team is watching every milestone, expecting results in weeks—not months.

This is where many financial institutions hit a hard, often invisible wall.

It’s not a lack of effort.

It’s not talent or strategy.

It’s the system.

More specifically, it’s the lending platform that orchestrates the journey from idea to launch. If the platform is rigid, developer-dependent, or fragmented, everything slows down. Every change request becomes a ticket. Every rule adjustment needs a sprint. Before long, the launch gets delayed—not because teams weren’t aligned, but because the tools couldn’t keep up.

Now compare two banks, both launching the same product:

- One uses a modern low-code platform that still routes key changes through IT.

- The other leverages a no-code engine where business teams directly manage configurations, test logic, and push updates.

The loan is the same. The launch timelines? Not even close.

This blog explores that difference—not through brochure promises, but from the inside out. We’ll look at how platform design directly affects velocity, efficiency, and ultimately, business outcomes.

Because in lending, speed isn’t just about faster builds.

It’s about operational independence.

Let’s dive into it.

1. Why Your LOS Choice Determines Lending Speed

In today’s lending environment, speed isn’t a luxury—it’s a competitive edge.

But it’s often misunderstood. Real speed isn’t about how quickly a developer can push code.

It’s about how seamlessly a bank or NBFC can take a loan product from concept to launch—fully compliant, risk-approved, and revenue-ready—without getting entangled in internal bottlenecks.

In reality, though, that kind of executional clarity is rare.

Sales wants the product live in two weeks.

Tech says it’ll take at least two months.

Risk hasn’t even reviewed the credit logic.

Compliance is still waiting on updated documentation.

And you? You’re caught in the middle—managing expectations, chasing approvals, and silently hoping your LOS holds up under pressure.

When your Loan Origination System lacks the agility to let business users configure logic, test eligibility flows, and launch without writing a line of code, then every team gets stuck waiting for someone else.

The result? A slow, frustrating journey full of delays that cost you more than just time—they cost you revenue, momentum, and credibility.

Let’s talk numbers—but not the usual kind. Let’s look at the KPIs that actually get hit when your LOS isn’t built for speed.

The KPIs That Break (or Accelerate) Because of LOS

| Function | Key KPI | LOS Impact |

|---|---|---|

| Credit | Time to Approve | Manual checks vs. pre-configured decision engine |

| Risk | Portfolio Quality | Rule rigidity or flexibility |

| Operations | TAT | Steps automated vs. steps requiring IT |

| Product | Time to Launch | Development dependencies vs. drag-and-drop |

| Compliance | Audit Trail Accuracy | Hardcoded vs. dynamic rule visibility |

| Sales | Revenue Realization | Speed of GTM and lead conversion |

In simpler terms:

A great LOS removes friction.

A poor one multiplies dependencies.

At the end of the day, speed isn’t just about how fast you build—it’s about how fast you can change, over and over again, without friction.

And when that speed is missing, the consequences are more than theoretical. They’re financial, reputational, real.

1.1. Real Story, Real Stakes – ₹900 Cr on Pause

In late 2022, one of India’s top NBFCs—managing a ₹12,000 Cr book and a strong SME lending portfolio—decided to launch a high-potential Working Capital Loan for MSMEs. The product was designed for digitally enabled businesses: GST-connected, API-driven, and ready for paperless processing.

On paper, it was a no-brainer.

- Ticket size: ₹10–20 lakh

- Target audience: 1.2 lakh MSMEs, already onboarded via banking and GST APIs

- Risk models: Fully automated using bureau, cash flow, and GST data

- Sales forecast: ₹900 Cr in disbursals within the first 90 days

But while the business case was airtight, the execution was anything but timely.

Because when it came time to launch, the real bottleneck emerged: the LOS.

Despite the strategic intent and market readiness, the launch was dragged down by systemic inefficiencies that no one had factored into the forecast

| Stage | Delay | Reason |

|---|---|---|

| Product Configuration | 3 Weeks Delay | No UI Configuration; backend development needed |

| Risk Models | 2 Weeks Delay | Rules hardcoded; queued with tech |

| Forms UI | 4 Weeks Delay | Static screens; developer required for changes |

| UAT Cycles | 3 Rounds Delay | Minor tweaks needed full releases |

| Go Live | 65 Day Delay | Missed GTM (Go-to-Market) window due to performance lag |

The result?

A 65-day delay on what should have been a flagship rollout.

In terms of disbursals, that translated to an opportunity cost of ₹650–900 Cr. The internal impact was just as harsh. The product lost momentum. The sales team disengaged. And the CFO began openly questioning the ROI on the so-called “digital transformation.”

As the VP of Lending later said during the post-mortem:

“We were digital on paper. But in practice, we were still waiting on XML files.”

And that one sentence said it all.

This wasn’t a tech failure—it was a systems mismatch. A product built for agility was shackled to a platform that couldn’t move fast enough. The problem wasn’t the idea, or the market, or the credit risk. It was the LOS that couldn’t keep pace with the ambition.

And that’s where the conversation around Low-Code vs No-Code gets serious.

2. Low-Code vs. No-Code: The Operational Divide Lenders Can’t Ignored

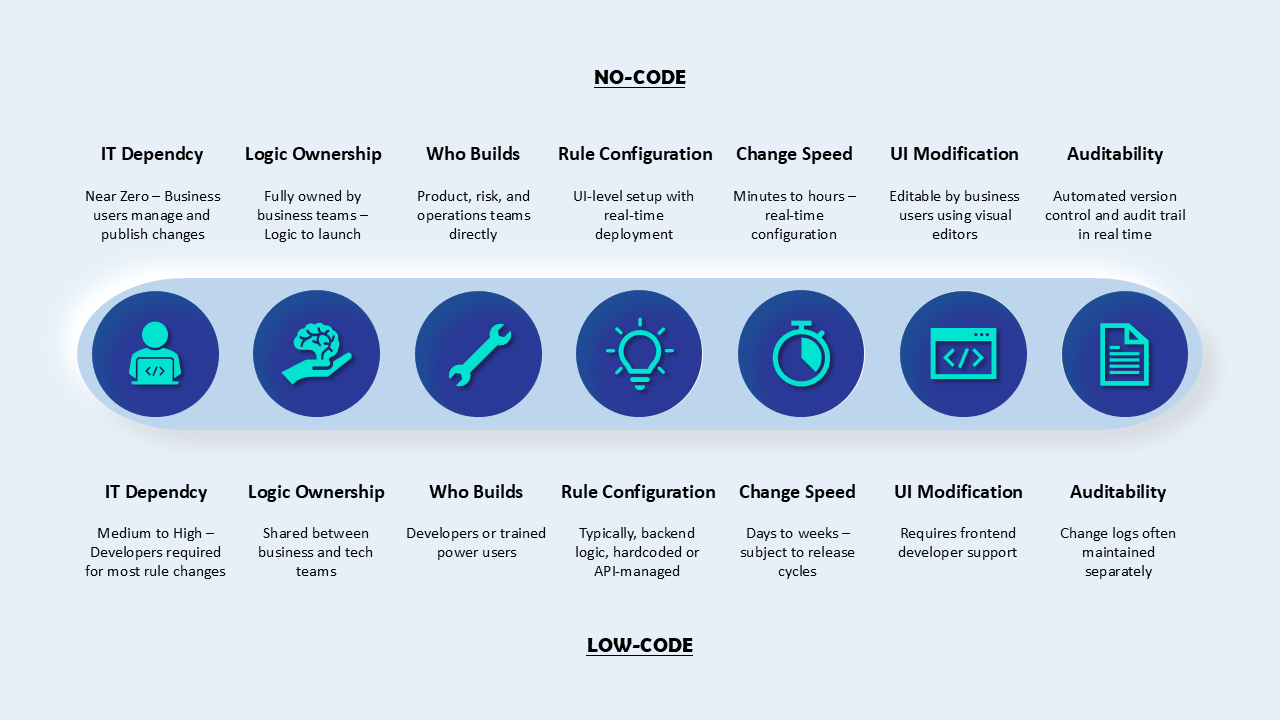

While many technology vendors use the terms “low-code” and “no-code” interchangeably, the operational impact of these platforms within a lending institution is anything but similar.

Especially when launching a new loan product, the difference between the two models directly influences go-to-market timelines, ownership of change, and ultimately, business outcomes.

Both approaches promise modern interfaces, reduced reliance on traditional development cycles, and faster deployment compared to legacy systems.

However, beyond the surface-level benefits, their underlying architectures and dependency models create very different realities for banks and NBFCs.

2.2. A Common Lending Scenario: The Rule Change Bottleneck

Let’s understand how this plays out in a real-world lending use case.

2.2. A Common Lending Scenario: The Rule Change Bottleneck

Consider a scenario where the Credit team decides to implement a risk policy update:

“If a borrower’s GST turnover has declined by more than 15% year-on-year, route the application to manual review.”

Under a low-code setup, this change initiates a standard sequence of dependencies:

- The rule is handed off to the technology team

- Logic is coded and tested in a backend system

- The change enters a scheduled release cycle

- A formal Jira (or equivalent) ticket is raised

- UAT must be completed

- Average turnaround: 3–5 business days (minimum)

Despite being labelled “agile,” this process introduces delays, creates inter-departmental bottlenecks, and hinders responsiveness to evolving business needs.

In contrast, under a true no-code platform:

- The risk analyst logs into the rule engine

- Navigates to the relevant segment and modifies the rule using a drag-and-drop UI

- Version control is automatically managed

- The update is tested in a sandbox and deployed—all within a few hours

No development cycles. No IT queue. No release delay.

This is the difference between reacting to market conditions in real time versus being held back by internal process inertia.

3. Who controls your journey?

This is the difference that separates loan velocity from loan inertia.

In low-code, tech controls the roadmap.

In no-code, business controls the momentum.

Bankers don’t want to code.

They want to launch faster, test faster, fail faster, fix faster.

It’s not about “who can build,” it’s about “who can change” without friction.

And That Changes the Equation for Everyone

| Role | Dream Outcome | With Low-Code | With No-Code |

|---|---|---|---|

| Risk | Test & deploy new scorecards weekly | Dev backlog | Self-serve rule studio |

| Credit | Auto-routing for new borrower logic | Needs deploy | Drag-drop logic builder |

| Product | Run A/B variant of UI screens | Requires FE team | Launch new variant from dashboard |

| Tech | Focus on infra & security | Stuck on feature backlog | Free to innovate, not maintain |

| Ops | Update SLAs, triggers, statuses | Needs workflow mapping | 1-click flow editor |

In short?

Low-code makes things easier.

No-code makes things faster—and scalable without bottlenecks.

And in lending, time isn’t just money.

Time is market share.

4. Five Dimensions That Make or Break the Lending Journey

Choosing between low-code and no-code isn’t just a tech decision. It defines:

- Who controls change

- How fast revenue flows

- How much time teams lose in loops and tickets

Let’s break down the five dimensions that shape real-world outcomes.

4.1. Speed of Launch

How quickly can a new loan product go live?

| Low-Code | No-Code |

|---|---|

| Setup takes weeks | Setup in days |

| Dev-led UAT cycles | Instant testing by business |

| Rule changes need tech | Self-configured, deploy-free |

4.2. Business Autonomy

Can business teams update journeys without IT?

| Low-Code | No-Code |

|---|---|

| IT controls workflows | Business runs configurations |

| Static forms & rules | Editable screens & logic |

| Needs release cycles | Instant updates by teams |

4.3. Agility to Adapt

How fast can you respond to change?

| Low-Code | No-Code |

|---|---|

| Change needs dev/test/deploy | Drag, save, done |

| A/B tests need IT | Built-in testing tools |

| Quarterly roadmap cycles | Daily iterations possible |

4.4. Maintenance Overhead

How much effort does upkeep demand?

| Low-Code | No-Code |

|---|---|

| Rule edits need deploys | Live-editable, versioned rules |

| UI bugs = dev time | Visual editor for quick fixes |

| Full regression for QA | Micro-testing by business |

4.5. Scalability of Journeys

How easily can you scale across products and segments?

| Low-Code | No-Code |

|---|---|

| Scaling = code new journeys | Clone, tweak, launch |

| New cases need dev bandwidth | Templates reused by teams |

| Tech team stretched | Business handles growth |

While frameworks and metrics are useful, nothing illustrates impact like a real-world scenario. The choice between low-code and no-code doesn’t just affect workflows—it reshapes outcomes on the ground. To see this in action, here’s a real case from a digital lending rollout where two teams—within the same bank—set out to launch the same MSME loan journey, but on different platforms.

5. A Case Snapshot: One Loan, Two Journeys

Scenario:

Two teams. Same bank. Same ₹50,000 MSME loan product.

One uses low-code, the other no-code (Lend.ezee).

Week 1: The Mandate Lands

| Low-Code Team | No-Code Team |

|---|---|

| War room with Product, Tech, Credit, Operations | Product configures in 2 hours |

| BRDs handed to developers | Risk and Operations build rules collaboratively |

| Needs 2 sprints + frontend changes | No tickets, no developer |

Week 2: Rules and Flows

| Low-Code | No-Code |

|---|---|

| Backend changes required | Risk team sets rules via drag-and-drop |

| UI bugs delay QA | Logic versioned and deployed instantly |

| Errors in validation | Salaried vs. self-employed flows live |

Week 4: UAT & Go-Live

| Low-Code | No-Code |

|---|---|

| 3rd UAT fails on logic mismatch | Business teams complete UAT in real-time |

| Go-live on Day 35 | Journey live on Day 14 |

| Manual launch coordination | API-led automated launch (SMS, WhatsApp) |

Final Outcome

| Metric | Low-Code Team | No-Code Team |

|---|---|---|

| Go-Live | Day 35 | Day 14 |

| Time to Revenue | Missed Q1 targets | ₹20 Cr in 3 weeks |

| Operations Load | 4x support tickets | Zero manual escalations |

| Product Variants | 1 variant | 3 flows (by user type) |

| Team Morale | “Stretched thin” | “Ready for next launch” |

Takeaway: The real difference wasn’t just speed—it was ownership, agility, and business impact.

6. When to Choose What – Matching Platform to Organisation’s Maturity

The choice between low-code and no-code isn’t black and white. As we saw in the MSME loan case, outcomes diverge sharply when platform capabilities don’t match team agility. But that doesn’t mean every lender should drop low-code overnight. The right platform is the one that aligns with your organization’s maturity, structure, and growth priorities.

This isn’t about tech preference—it’s about business alignment.

6.1. When Low-Code Still Makes Sense

Low-code continues to add value—especially in institutions where IT plays a central role, and systems are deeply customized and governed.

Typical Organisation Profile:

1. Large universal banks with full-stack IT teams

2. Legacy architecture with complex integration needs

3. Governance-heavy release pipelines

Best Use Cases:

1. Building proprietary internal modules

2. Orchestrating multi-system workflows

3. Running tightly controlled experiments under tech oversight

Trade-Offs:

1. Slower go-to-market cycles

2. Higher dependence on developers

3. Delayed iterations for business teams

Example: A regional bank in Australia with 90+ developers built a custom co-lending engine on low-code—but a minor post-launch tweak took 6 months due to code dependencies and release cycles.

6.2. When No-Code Is the Winning Play

No-code platforms unlock value where speed, autonomy, and flexibility are business imperatives—not luxuries.

Typical Org Profile:

1. Digital NBFCs, agile banks, and fintech lending arms

2. Lean IT, but strong product and risk teams

3. Need for rapid market responsiveness and partner variations

4. Empowered business functions leading innovation

Best Use Cases:

1. Fast rollout of new loan journeys

2. Rule testing and logic configuration by credit/risk teams

3. Workflow automation and SLA-driven operations

4. Scaling product variants across geographies or segments

Trade-Offs:

1. Requires guardrails to avoid logic sprawl

2. Success depends on business team enablement

3. Governance needs to shift from control to collaboration

Example: A top Indian NBFC launched 5 product variants in 60 days—fully managed by business teams on Lend.ezee. Zero dev backlog. Zero deployment delays.

6.3. Still Deciding? Ask These 3 Questions

1. Do you want business teams to own and change journeys without tech?

→ Go No-Code.

2. Can your IT team match your product velocity?

→ Low-Code might work. If not, reconsider.

3. What’s your tolerance for launch delays?

→ If it’s under 30 days, only No-Code delivers.

No-Code doesn’t mean no governance.

It means faster execution with embedded controls—so lenders can move with speed, safety, and scale.

The Final Word – Build for Agility, Win with Speed

In today’s lending landscape, the speed of execution is no longer a tactical advantage—it’s a strategic necessity.

When a new loan journey is stuck in limbo, you’re not just facing internal delays.

You’re watching revenue slip, teams stretch thin, and timing windows close before you even get to the starting line.

But true speed isn’t about one-time acceleration.

It’s about the ability to adapt repeatedly—across teams, across use cases, and across business cycles—without resetting the system or retraining the organization.

Because what separates leaders from laggards today?

It’s not the tech they use—it’s how well that tech fits how their teams actually operate.

When systems enable cross-functional ownership, embed control into configuration, and reduce dependency without sacrificing compliance—change becomes operationally effortless.

Ultimately, the most resilient lending institutions today don’t just grow;

They adapt.

They recover.

They move forward without missing a beat.

That’s the benchmark now—not faster code, but faster outcomes.

And the systems that deliver them will quietly define the next wave of lending leaders.