1. Why Collections Needs a Smarter Brain Picture this. You’re not just managing collections. You’re accountable for liquidity recovery, portfolio hygiene, and risk containment. Collections today isn’t a back-office function—it’s the front line of financial resilience. It’s Monday morning. Your dashboard is flooded. 1. DPD 30s are growing faster than…

Build Lending Products Like You Build Slides

Drag, Drop, Automate with AI

Launch credit journeys in just one day with our No-Code AI platform.

Build complete flows with screens, fields, rules, and workflows—without a single line of code.

Why Banks Choose ezee.ai to Build Credit Journeys

Your Complete Lending Technology Suite

Three powerful platforms that work together to transform how you

build, deploy, automate and manage lending products.

Launch Credit Products in Weeks, Not Quarters

Cut loan processing time by 70%

Boost STP rates by 50%

Turn Collections into Customer Conversations

Cut collection cycle times by 60%

Handle 10x more accounts

Optimize, Automate & Accelerate Lending Decision

Launche complex rules in minutes

Reduce decisioning time by 80% with AI

Supporting Every Asset Type with AI Precision

Our flexible platform powers lending across all asset types with live implementations globally

- Configure any asset type with drag-and-drop workflows

- Pre-trained models for each asset class and geography

- Launch new asset types in days, not months with AI

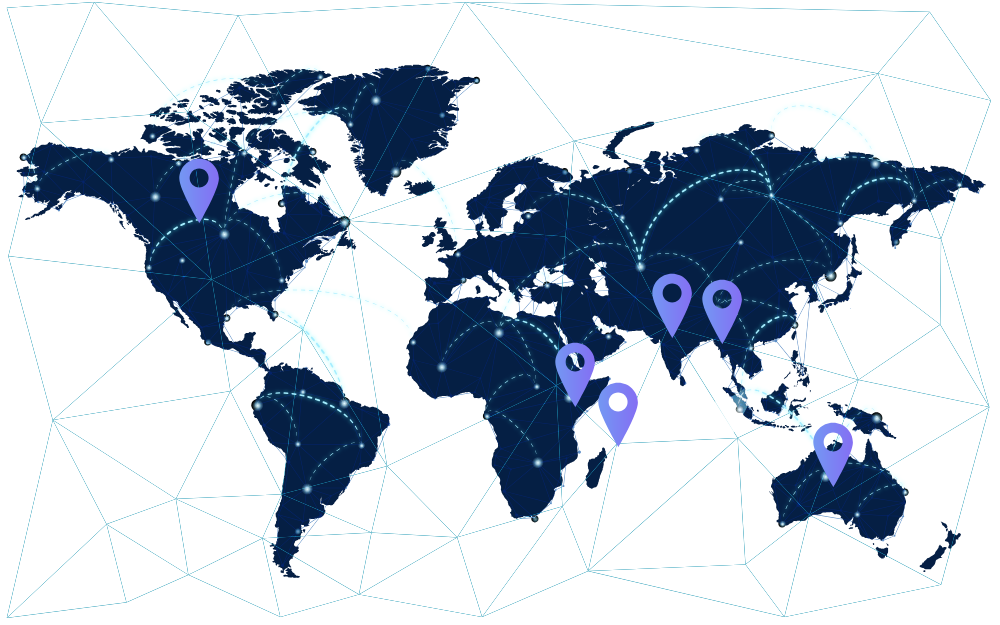

Global Footprint

100+ Customers across 4 Continents, processing $100 million accounts and $2 billion in loans annually

Trusted by 100+ Banks & NBFCs Across Segments

Financial institutions globally choose ezee.ai for its unparalleled security, compliance, and AI-driven automation capabilities.

14 out of 43 RRBs in India Run on ezee.ai

Enterprise Security & Compliance

Meeting the most stringent regulatory requirements while enabling innovation

Real Implementations, Real Results

See how leading financial institutions launch credit products with unprecedented speed using ezee.ai

Tier 1 NBFC Launches SME Platform in 28 Days Straight

Leading NBFC deployed complete SME lending stack with AI-powered risk assessment and automated workflows.

300% faster processing

Regional Bank Automates Gold Loan Processing

Full gold loan journey with automated valuation, instant approvals, and digital documentation.

90% reduction in manual tasks

Fintech Scales Vehicle Financing with No-Code

Multi-asset vehicle financing platform with drag-and-drop workflow builder and AI decisioning.

5x faster product iterations

Co-Lending Platform Powers Bank-NBFC Partnership

Seamless multi-party lending workflows enabling risk sharing and automated reconciliation.

$100M+ loan volume

Lending Innovation, Explained Simply

Insights from the frontlines of digital lending transformation.

Business Rule Engines: Driving Clear, Confident Decisions

A Simple Idea. A Big Impact. In lending, every second counts.Who gets approved. What offer goes out. When action is triggered.These aren’t just decisions—they're the engine behind growth, risk, and trust. But when the rules driving those decisions are slow to change, hard to see, or stuck with IT teams,…

The ROI of Omnichannel Collections: Faster Recovery, Lower Friction

Most of us in lending grew up with phones at the heart of collections. We built scripts. We hired and trained agents. We tracked dial attempts and pickup rates as key indicators of success. But borrowers have changed. And quietly, so has the game. Today, people are constantly online—but rarely…

Inside a Smart Collection Stack: Must-Have Tools and Integrations

Where Collections Fail—and Where They Can Soar If you manage collections at a bank or NBFC, this much is clear: It’s not the DPD count alone that’s keeping you up at night—it’s the ticking clock. Because after 30 days past due, every hour matters. Recovery probability doesn’t just decline—it plummets.…

How to Choose a LOS That Grows With You

Today, offering a loan isn’t just about giving credit. It's about delivering seamless, fast, digital-first experiences that borrowers now expect. But here’s the thing nobody tells you: almost every broken borrower journey can be traced back to one outdated system in the backend—your LOS. Bankers chase disbursal speed, low NPAs,…

API-Driven Credit Scoring: Plug-and-Play Risk Models for Agile Lenders

For decades, lenders relied on monolithic loan origination systems built to support scale and compliance. But those very systems — once considered the backbone of growth — are now turning into barriers. Product launches are delayed by weeks, sometimes months. Updating a credit scorecard requires coordination across multiple teams. Introducing…

One Loan, Two Journeys: No-Code vs. Low-Code from the Inside Out

Launching a new loan product is one of the most cross-functional, high-pressure efforts in modern banking. It’s not just about getting the underwriting logic right. It’s about aligning multiple departments—credit, risk, compliance, operations, legal, product, and technology—under tight deadlines and even higher expectations. Each team brings different priorities to the…

Smarter by Design: Why Modern Rule Engines Need UI Flexibility and Modular Architecture

1. Imagine: Your Risk Team Wants to Tweak a Rule. It Takes Three Weeks. It’s a Monday morning. Your product head has a brilliant idea: launch a limited-time offer for pre-approved customers under 28, in metros, with no current liabilities, and a credit score over 720. You nod. Great idea.…

Rule Engines in Collections: Automating Empathy, Efficiency, and Escalation

1. Why Collections Needs a Smarter Brain Picture this. You’re not just managing collections. You’re accountable for liquidity recovery, portfolio hygiene, and risk containment. Collections today isn’t a back-office function—it’s the front line of financial resilience. It’s Monday morning. Your dashboard is flooded. 1. DPD 30s are growing faster than…

Business Rule Engines: Driving Clear, Confident Decisions

A Simple Idea. A Big Impact. In lending, every second counts.Who gets approved. What offer goes out. When action is triggered.These aren’t just decisions—they're the engine behind growth, risk, and trust. But when the rules driving those decisions are slow to change, hard to see, or stuck with IT teams,…

The ROI of Omnichannel Collections: Faster Recovery, Lower Friction

Most of us in lending grew up with phones at the heart of collections. We built scripts. We hired and trained agents. We tracked dial attempts and pickup rates as key indicators of success. But borrowers have changed. And quietly, so has the game. Today, people are constantly online—but rarely…

Inside a Smart Collection Stack: Must-Have Tools and Integrations

Where Collections Fail—and Where They Can Soar If you manage collections at a bank or NBFC, this much is clear: It’s not the DPD count alone that’s keeping you up at night—it’s the ticking clock. Because after 30 days past due, every hour matters. Recovery probability doesn’t just decline—it plummets.…

How to Choose a LOS That Grows With You

Today, offering a loan isn’t just about giving credit. It's about delivering seamless, fast, digital-first experiences that borrowers now expect. But here’s the thing nobody tells you: almost every broken borrower journey can be traced back to one outdated system in the backend—your LOS. Bankers chase disbursal speed, low NPAs,…

API-Driven Credit Scoring: Plug-and-Play Risk Models for Agile Lenders

For decades, lenders relied on monolithic loan origination systems built to support scale and compliance. But those very systems — once considered the backbone of growth — are now turning into barriers. Product launches are delayed by weeks, sometimes months. Updating a credit scorecard requires coordination across multiple teams. Introducing…